IRSC Calendar 2024-2025: Navigating the complexities of tax compliance requires a firm grasp of key deadlines. This calendar serves as an indispensable guide for individuals and businesses alike, outlining crucial dates for tax filing, payments, and other IRS-related obligations. Understanding this calendar is paramount for effective tax planning and minimizing potential penalties.

This comprehensive guide details the significant dates for both individual and business taxpayers, offering strategies for proactive tax planning and highlighting the potential consequences of missed deadlines. We will explore the nuances of the IRS calendar, comparing deadlines for different business structures and providing resources to stay updated on any changes.

Understanding the IRS’s Calendar Significance: Irsc Calendar 2024-2025

The IRS calendar plays a crucial role in both tax planning and compliance for individuals and businesses. Understanding key deadlines and tax form requirements is essential for avoiding penalties and ensuring smooth tax filing. Careful attention to the IRS calendar allows for proactive tax management, minimizing potential issues and maximizing tax benefits.

Key Dates and Deadlines for Individuals and Businesses

The IRS calendar is filled with important dates that affect taxpayers. These deadlines vary depending on whether you are an individual or a business, and understanding these differences is paramount. For individuals, the primary deadline is typically April 15th, while businesses often have different filing deadlines depending on their structure and accounting methods. Missing these deadlines can result in penalties and interest charges.

Therefore, proactive planning and accurate record-keeping are essential.

Tax Forms and Their Due Dates, Irsc calendar 2024-2025

Numerous tax forms are used for various tax situations. Some common forms for individuals include Form 1040 (U.S. Individual Income Tax Return), Form W-2 (Wage and Tax Statement), and Form 1099 (Miscellaneous Income). Businesses may use forms like Form 1120 (U.S. Corporation Income Tax Return), Form 1065 (U.S.

Return of Partnership Income), and various other forms depending on their specific business structure and activities. Each form has its own specific due date, and it is critical to file the correct forms by their respective deadlines. Failure to do so can lead to significant penalties.

Planning your year with the IRSC calendar 2024-2025? Remember to factor in personal time off, perhaps for a relaxing getaway. If you’re considering a cruise, you might find some great options by checking out cruises 2025 from baltimore md to see if any coincide with your schedule. Once you’ve finalized your vacation plans, you can seamlessly integrate them into your IRSC calendar 2024-2025 for a well-organized year.

Key IRS Deadlines for 2024 and 2025

The following table Artikels key deadlines for both individual and business filers. Note that these dates are subject to change, and it’s crucial to consult the official IRS website for the most up-to-date information. Always verify these dates annually to ensure compliance.

| Category | Deadline 2024 | Deadline 2025 | Description |

|---|---|---|---|

| Individual Income Tax | April 15, 2024 | April 15, 2025 | Filing deadline for Form 1040 |

| Estimated Tax Payments (Individuals) | April 15, June 15, September 15, January 15 | April 15, June 15, September 15, January 15 | Quarterly payments for self-employed individuals and others |

| Corporate Income Tax | March 15, 2024 | March 15, 2025 | Filing deadline for Form 1120 |

| Partnership Income Tax | March 15, 2024 | March 15, 2025 | Filing deadline for Form 1065 |

Impact of the IRS Calendar on Taxpayers

The IRS calendar significantly impacts taxpayers, dictating crucial deadlines for filing returns, paying taxes, and taking advantage of various tax benefits. Understanding this calendar is not merely beneficial; it’s essential for navigating the tax system effectively and avoiding potentially serious consequences. Failure to adhere to the IRS’s schedule can lead to penalties, interest charges, and even legal repercussions.

Planning your year with the IRSC calendar 2024-2025? Remember to factor in personal travel, especially if you’re considering a Disney cruise. Finding out when Disney will release their 2025 cruise dates is crucial for booking, so check this helpful resource: when will disney release 2025 cruise dates. Once you have those dates, you can seamlessly integrate them into your IRSC calendar 2024-2025 for a complete overview of your year.

Proactive tax planning, informed by the IRS calendar, allows taxpayers to optimize their tax liability and minimize their risk.The IRS calendar’s influence extends beyond simply knowing when to file. It provides a framework for strategic tax planning throughout the year. By understanding the deadlines and requirements, taxpayers can better manage their income and expenses, potentially reducing their overall tax burden.

Planning your year with the IRSC calendar 2024-2025? Remember to factor in personal travel, especially if you’re considering a Disney cruise. Finding out when Disney will release their 2025 cruise dates is crucial for booking, so check this helpful resource: when will disney release 2025 cruise dates. Once you have those dates, you can seamlessly integrate them into your IRSC calendar 2024-2025 for a complete overview of your year.

This proactive approach helps shift the focus from reacting to deadlines to strategically planning for them, leading to greater financial control.

Consequences of Missing IRS Deadlines

Missing IRS deadlines can result in a range of penalties and interest charges. For example, failing to file a tax return by the deadline will typically incur a penalty calculated as a percentage of the unpaid tax. Late payment penalties are also common, often accruing interest from the due date until the tax is fully paid. In more serious cases, intentional disregard for deadlines can lead to more significant penalties and even legal action from the IRS.

The specific penalties and interest rates are subject to change and depend on factors such as the amount of tax owed and the reason for the delay. It is crucial to consult the IRS website or a tax professional for the most up-to-date information.

Planning your events for the IRSC calendar 2024-2025? Consider adding significant dates like major sporting events. For instance, you might want to note the dates for the world transplant games 2025 , a truly inspiring competition. Returning to the IRSC calendar, remember to factor in ample time for scheduling and preparation to avoid conflicts.

Strategies for Effective Tax Planning Based on the IRS Calendar

Effective tax planning involves utilizing the IRS calendar to anticipate and prepare for upcoming tax obligations. This could include setting aside funds throughout the year specifically for tax payments, making estimated tax payments on time, or adjusting withholding from your paycheck to align with your expected tax liability. For instance, self-employed individuals can use the quarterly estimated tax payment system, guided by the IRS calendar, to avoid a large tax bill at the end of the year.

This prevents the stress and potential penalties associated with a significant tax liability that may not have been properly budgeted for. Additionally, understanding the deadlines for tax credits and deductions allows taxpayers to take advantage of these opportunities to reduce their overall tax burden.

Examples of Avoiding Penalties by Understanding the IRS Calendar

Consider a taxpayer who is self-employed and understands the quarterly estimated tax payment deadlines Artikeld in the IRS calendar. By making timely payments throughout the year, they avoid penalties associated with underpayment of estimated taxes. Similarly, a taxpayer who is aware of the annual tax filing deadline can ensure they submit their return on time, preventing late-filing penalties. Another example could be a taxpayer who proactively gathers all necessary tax documents well before the filing deadline, avoiding last-minute scrambling and potential errors that might lead to delays and penalties.

Understanding the IRS calendar allows for proactive preparation and helps prevent common mistakes that often result in penalties.

Proactive Steps to Meet Deadlines

Proactive steps are crucial for meeting IRS deadlines.

- Mark important tax dates on a calendar.

- Set up automatic payments or reminders for estimated taxes.

- Gather all necessary tax documents well in advance of the filing deadline.

- Consult a tax professional for personalized guidance.

- Regularly check the IRS website for updates and announcements.

IRS Calendar and Business Tax Obligations

The IRS calendar significantly impacts businesses of all sizes, dictating crucial deadlines for tax filings and influencing financial planning. Understanding these deadlines and their implications is essential for maintaining compliance and ensuring smooth financial operations. This section will compare and contrast tax obligations for different business structures, identify key tax forms and their due dates, and demonstrate how the IRS calendar directly affects business budgeting and financial planning.

Tax Deadlines: Corporations vs. Sole Proprietorships

Corporations and sole proprietorships, while both business structures, face distinct tax filing requirements and deadlines. Corporations, as separate legal entities, typically file Form 1120, U.S. Corporation Income Tax Return, by the 15th day of the fourth month following the end of their tax year. Sole proprietorships, on the other hand, report their business income and expenses on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), which is filed with their individual income tax return (Form 1040) by the tax filing deadline for individuals, typically April 15th.

This difference in deadlines stems from the differing legal structures and reporting requirements. Extensions are available for both, but the underlying deadlines remain critical benchmarks.

Relevant Business Tax Forms and Due Dates

Several tax forms are relevant to businesses, depending on their structure, activities, and financial situation. For example, Form 1065, U.S. Return of Partnership Income, is used by partnerships, while Form 1041, U.S. Income Tax Return for Estates and Trusts, is used by estates and trusts. These forms, along with their associated schedules and forms, often have different due dates than individual tax returns or corporate returns.

For example, Form 1065 usually has a March 15th deadline for partnerships with a calendar year, and Form 1041 typically has an April 15th deadline. Accurate understanding of these deadlines is paramount to avoiding penalties. The IRS website provides a comprehensive list of all business tax forms and their associated due dates.

Planning your year with the IRSC calendar 2024-2025? Remember to factor in personal travel, especially if you’re considering a Disney cruise. Finding out when Disney will release their 2025 cruise dates is crucial for booking, so check this helpful resource: when will disney release 2025 cruise dates. Once you have those dates, you can seamlessly integrate them into your IRSC calendar 2024-2025 for a complete overview of your year.

IRS Calendar’s Impact on Business Budgeting and Financial Planning

The IRS calendar directly impacts a business’s budgeting and financial planning process. Businesses must factor in estimated tax payments throughout the year, based on their projected income and expenses. These quarterly payments, usually due on April 15th, June 15th, September 15th, and January 15th, help businesses avoid penalties for underpayment. Accurate forecasting of income and expenses is critical to ensure sufficient funds are available for timely tax payments.

Failure to properly account for tax obligations can lead to cash flow problems and potentially hinder business growth. Furthermore, the annual tax filing deadlines significantly influence the timing of year-end financial reporting and the preparation of financial statements.

Business Tax Filing Flowchart

The following flowchart illustrates the typical steps involved in filing business taxes, referencing relevant dates from the IRS calendar (assuming a calendar year for simplicity):[Diagram Description: A flowchart would be visually represented here. The flowchart would begin with “Year-End Business Operations,” leading to “Gather Financial Records” (October – December). This would branch to “Prepare Tax Forms” (January – March), which then leads to “Calculate Estimated Tax Liability” (March).

From “Calculate Estimated Tax Liability,” one branch leads to “Make Estimated Tax Payments” (April 15th, June 15th, September 15th, January 15th), while another branch leads to “File Tax Return” (April 15th or relevant deadline based on business type). The flowchart concludes with “Record Tax Payments and File Confirmation.” Specific tax forms (e.g., Form 1120, Schedule C, etc.) could be indicated at the appropriate stages.]

Changes and Updates to the IRS Calendar

The IRS calendar, while generally consistent, is subject to occasional revisions. These changes can stem from various factors, including legislative updates, technological advancements, and unforeseen circumstances. Understanding these potential shifts is crucial for taxpayers and businesses to accurately plan their tax obligations. This section will explore anticipated changes for the 2024-2025 tax year and provide resources for staying informed.The IRS typically releases its official calendar several months before the start of the tax year.

While specific details for the 2024-2025 calendar won’t be available until closer to the relevant time, we can examine potential areas of change based on past trends and current events. A comparison with previous years’ calendars reveals patterns that can offer insights into possible modifications.

Comparison of 2024-2025 Calendar with Previous Years

Predicting precise changes to the IRS calendar is difficult without official announcements. However, based on historical data, we can anticipate some minor adjustments to deadlines. For instance, the tax filing deadline may shift slightly depending on the day of the week on which April 15th falls. If April 15th is a weekend or a holiday, the deadline is typically extended to the next business day.

Significant changes are less frequent, often resulting from major legislative actions. For example, the passage of the Tax Cuts and Jobs Act of 2017 led to substantial changes in tax rates and deadlines, necessitating calendar updates. A comparison of the 2024-2025 calendar with previous years will primarily focus on such minor date adjustments related to weekend or holiday occurrences.

A thorough comparison will only be possible once the official IRS calendar is released.

Resources for Up-to-Date Information

The most reliable source for the official IRS calendar is the IRS website itself (irs.gov). The website typically publishes the calendar well in advance of the tax year. Tax professionals and accounting firms also frequently provide updates and analyses of the calendar, offering interpretations and guidance. Subscribing to IRS email alerts or following their social media channels can provide timely notifications of any changes or updates.

It is crucial to rely on official sources to avoid misinformation.

Factors Influencing IRS Calendar Changes

Several factors can influence modifications to the IRS calendar. These factors range from legislative adjustments to technological improvements and unforeseen events.

- Legislative Changes: New tax laws or amendments to existing laws often necessitate changes to deadlines and filing requirements, directly impacting the IRS calendar.

- Technological Advancements: Improvements in tax processing systems could lead to adjustments in deadlines or the introduction of new electronic filing options, influencing the calendar’s structure.

- Unforeseen Circumstances: Major events, such as natural disasters or national emergencies, may necessitate temporary extensions or adjustments to deadlines.

- Workload Management: The IRS may adjust deadlines to better manage its workload and ensure efficient processing of tax returns. This is less frequent but can occur in response to significant shifts in filing patterns or technological challenges.

- Holiday Shifts: The placement of holidays on or near key tax deadlines regularly causes minor shifts in the official calendar to accommodate for weekend or holiday extensions.

Visual Representation of the IRS Calendar

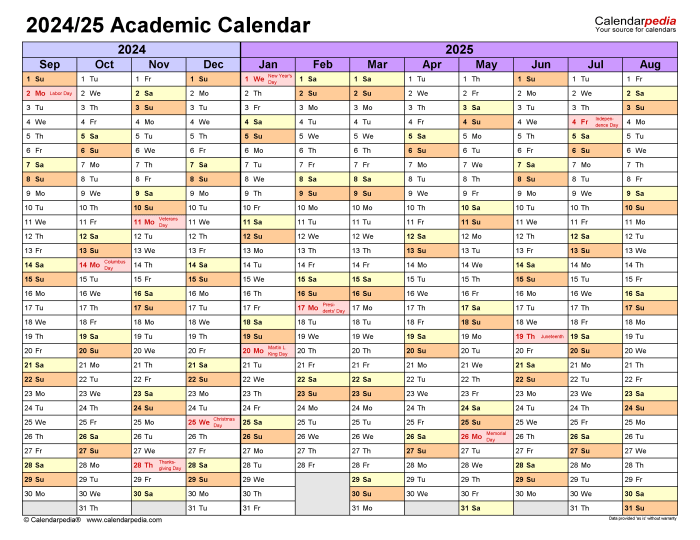

A well-designed visual representation of the IRS calendar for 2024-2025 significantly enhances understanding and accessibility compared to a purely textual format. By employing visual cues, key dates and deadlines become immediately apparent, reducing the risk of missed obligations.A visual calendar should prioritize clarity and ease of navigation. This can be achieved through a combination of strategic color-coding, informative icons, and a logical layout.

Visual Calendar Design

The calendar could be presented as a large, vertically oriented chart. Each month would occupy a distinct section, possibly using a different pastel shade for each month to distinguish them visually. Key dates, such as tax filing deadlines, quarterly estimated tax payments, and other important IRS dates, would be highlighted with a bold, contrasting color, such as a deep blue or vibrant green.

Each highlighted date would be accompanied by a small, easily identifiable icon. For example, a small calendar icon could represent tax filing deadlines, a dollar sign icon could represent payment deadlines, and a magnifying glass icon could represent important informational releases or updates from the IRS. The text accompanying each date would be concise and clearly visible, using a sans-serif font for readability.

The layout should be uncluttered, with ample white space to prevent visual fatigue. The entire calendar could be easily printable for convenient reference.

Benefits of Visual Representation

Visual calendars offer several key advantages over textual representations. They provide a more intuitive and immediate understanding of important dates and deadlines. The use of color-coding and icons allows for quick identification of critical information, reducing the time spent searching through dense textual data. This visual approach is particularly beneficial for those who are not familiar with tax regulations or find it difficult to process large amounts of textual information.

Furthermore, a visual calendar serves as a more engaging and memorable tool, increasing the likelihood of compliance with IRS deadlines.

Alternative Visual Formats

Infographics provide a concise summary of the most crucial IRS deadlines for the year. They can be designed to highlight key tax obligations for different taxpayer categories (individuals, businesses, etc.), making them particularly useful for quick reference. An infographic might use a timeline format to visually represent the sequence of tax-related events throughout the year, making it easier to understand the overall tax calendar.Interactive calendars, accessible online, offer even greater flexibility and functionality.

Users could filter the calendar to display only relevant dates based on their specific tax situation. For instance, a self-employed individual could filter the calendar to show only deadlines related to estimated tax payments. Interactive calendars could also incorporate links to relevant IRS publications and forms, providing immediate access to more detailed information. This dynamic approach fosters a more personalized and user-friendly experience.